If you’re sending valuable items abroad from Pakistan—like smartphones, electronics, fashion items, gifts, lab equipment, or business samples—insurance is your safety net. Without it, Insurance Rates 2025 TCS International Parcel a lost or damaged parcel might only get minimal compensation under limited liability rules. This guide explains how TCS calculates and applies insurance for international parcels, how to estimate your total cost, and how to avoid claim issues. You’ll also find practical examples, checklists, and claim tips.

What Courier “Insurance” Means

Courier insurance is an extra service you pay for so that if your shipment is lost or significantly damaged, you are compensated based on the declared or market value—not just the minimal per-kg payout allowed under standard liability. TCS International Parcel

Key takeaway: Insurance = a small premium now to prevent a big financial loss later.

How to Check TCS International Insurance Rates

Step 1 — Get a Base Shipping Quote

Use TCS’s official Rate & Transit Calculator. Select your origin, destination, date, and shipment weight (and dimensions if needed). Note the base freight cost—insurance is added later. TCS International Parcel

Pro tip: If your item is light but bulky, check volumetric weight; you’ll be charged for whichever is higher—actual or volumetric.

Step 2 — Declare Your Item’s Value (Accurately)

At the counter or on the consignment note, declare the true value of your goods. This value becomes your maximum coverage limit under insurance. TCS International Parcel

- Under-declaring reduces your payout potential.

- Over-declaring can cause scrutiny and doesn’t guarantee higher compensation.

Step 3 — Ask to Add Insurance

Request insurance at the branch. Your premium is generally calculated as a percentage of the declared value (with a minimum charge). Confirm both the premium and the insured value before paying. TCS International Parcel

Step 4 — Get the Final Total and Receipt

Your receipt should clearly show:

- Destination, weight, and base freight

- Declared value

- Insurance premium charged

- Insured value

Keep this receipt safe—it’s essential for any claim.

Without Insurance – The Risk

Without insurance, compensation is limited, often calculated per kilogram. This may be far less than your item’s actual worth.

Example Cost Estimate – Narrative

Scenario:

- Item: Smartphone

- Declared Value: PKR 120,000

- Destination: Germany

- Weight: 1.0 kg (chargeable weight)

Get the base freight from the calculator, then add the insurance premium at the branch. The total cost will be:

Base Freight + Insurance Premium (plus any taxes or duties in the destination country, which are separate).

Declared Value 101

Your declared value is the actual market value of your shipment, backed by documents like an invoice or payment proof. Some cargo policies use: TCS International Parcel

Invoice Value + Freight + 10% as insured value (confirm with TCS at booking).

What TCS Insurance Usually Covers

Covered:

- Loss in transit

- Significant damage in transit (with proof)

Not Covered:

- Prohibited items (cash, gems, certain batteries, hazardous goods)

- Poor packaging

- Inherent vice (items naturally prone to damage/spoilage)

- Force majeure events

Claim Tips for Maximum Success

- Keep proof that your parcel was insured (receipt, airway bill)

- Keep proof of value (invoice, payment record)

- Take packing photos before shipping

- Report issues promptly to TCS

Packaging – Don’t Skip This Step

Insurance can be void if packaging is inadequate.

- Use double-wall cartons for fragile/electronic items

- Bubble-wrap each item individually

- Fill empty spaces with cushioning

- Seal with the “H-tape” method

- Declare batteries correctly

When Insurance is Worth It

- Declared value is high compared to freight

- Item is hard to replace

- Route involves multiple transfers or remote delivery

RedBox Parcels & Insurance

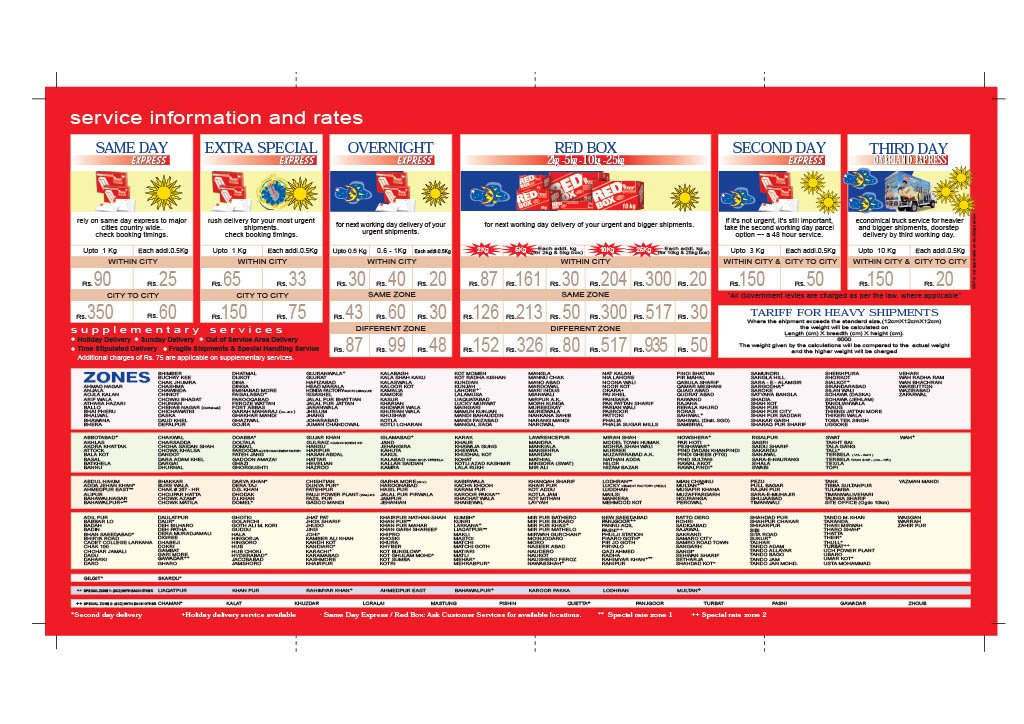

RedBox offers fixed-weight, fixed-rate shipping for set weight slabs. Insurance works the same way—declare value, request insurance, confirm on receipt.

Real Example – Hina’s Story

Hina from Lahore shipped a bridal dress worth PKR 180,000 to the UK. She declared the full value, added insurance, followed packaging guidelines, and kept her receipt. When a later shipment was mishandled, her claim was processed successfully because all documentation matched TCS requirements.

Quick Pre-Shipment Checklist

- Get a live base quote from the TCS calculator

- Declare the true value with proof

- Add insurance and confirm coverage on receipt

- Use compliant packaging and correct labels

- Keep photos and documents for claims